Economic Development

Dave Geohegan

City Planner

c/o City of Highland Heights

176 Johns Hill Road

Highland Heights, KY 41076

859-441-8575 (office)

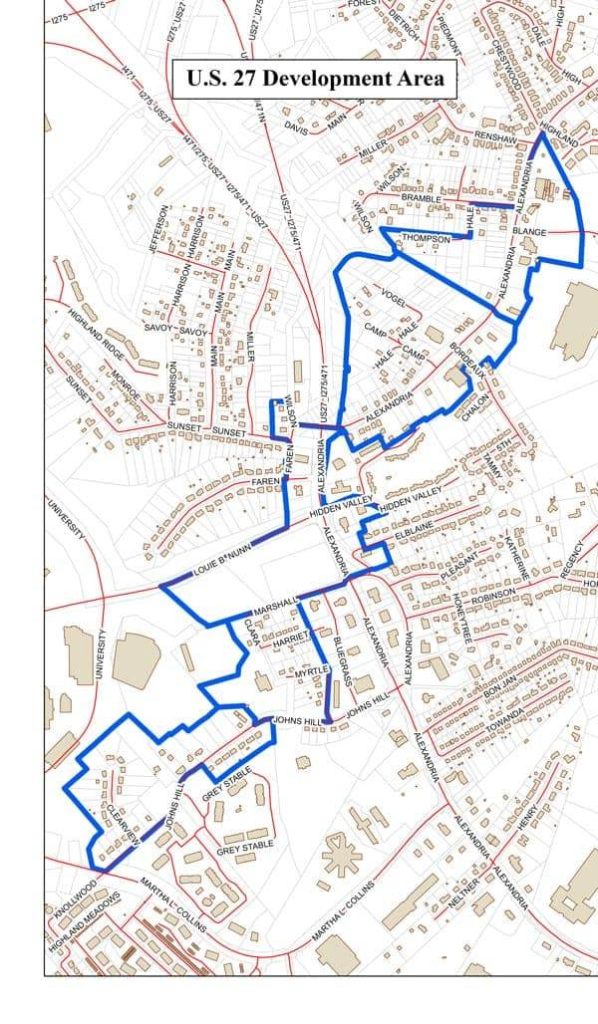

US 27 Development Area

US 27 - Development Area

US-27 & Nunn Drive Construction Update May 8, 2019

Phase I of the NKU Mixed-use project, an approximately 65,000 SF Medical Office Building, is proceeding as planned. The new 3-story, state-of-the art medical facility will provide much needed healthcare services to Highland Heights and area residents while generating new economic impacts to a previously underutilized and important gateway into the community. Construction commenced last fall and the building remains on schedule to open in the spring of 2020.

With less than a year of construction remaining for Phase I, efforts remain ongoing to mitigate construction impacts to neighbors and businesses. The development and construction team recognizes that like any large scale construction project, there will be impacts to the surrounding neighbors with respect to noise, traffic, access, etc., but whenever issues do arise, the key is always good communication. As it has from the start of the project, the team is committed to keeping open lines of communication and welcomes any feedback.

Predevelopment efforts continue to move Phase II of the project forward, planned for on the south side of Nunn Drive at the entrance to NKU. As envisioned, this next phase is anticipated to include hospitality, retail, restaurants, entertainment, residential and community focused amenities. Much of the focus of late has been on structuring the public-private partnerships (P3) that will enable the successful delivery of the community’s vision for this important connection between NKU’s campus and the Highland Heights community. Although the final scope specifics of the next phase are still being developed while the P3 details are arranged, the development team expects that process to conclude in the next few months and is excited to share further updates as the next phase draws closer.

Tax Increment Financing District

As part of the city’s land use strategy, it has created a Tax Increment Financing District to encourage redevelopment in targeted areas. The newly created incremental revenue generated from real property taxes by development in the TIF District can be used to help pay for number of eligible development costs of a project. For more information about the city’s TIF incentives and other economic development initiatives, please contact Dave Geohegan at 859-441-8575.

Highland Heights TIF Information

CCFC Highland-Heights US-27 TIF Handout

US-27 DEVELOPMENT AREA

“Highland Heights’ implementation of a tax increment financing (TIF) district exemplifies how serious our City is about encouraging growth through progress. Through this tool, our community seeks to actively encourage new development and redevelopment opportunities in key target areas.”

WHAT IS TIF?

Incentive Overview & Use in Highland Heights

A TIF district is an economic development incentive where public agencies set aside a percentage of new tax revenue derived from the future value of improved property or new businesses to pay for the current costs of development. For this area TIF, the City and County essentially reserve the pledged revenues separate from normal tax revenues, and those pledged monies may only be used to make improvements in the TIF district. In Highland Heights, Kentucky, the City has pledged 80% of new property, payroll, and occupational license taxes to the district; Campbell County also participates by pledging 60% of new property and payroll taxes for parcels and businesses in the targeted areas. TIF districts are critical to development because necessary infrastructure that is pivotal to a project’s success is usually prohibitively costly for a developer or business to bear out exclusively. TIF is the key public sector assistance mechanism to aid in significant real property development.

HOW DOES TIF WORK?

Implications for Businesses and Developers

If a property or business falls within the bounds of a TIF district, there is no difference in what property or business owners pay in any type of tax. Rather, on the back end, the City and County reserve the proper allocation of new taxes for potential use each year the TIF is active. Since TIF is an incentive, those seeking to do major projects within the TIF generally request the City leverage TIF as part of financing approved costs in their project. However, absent an active project, a committee of City and County representatives meet annually to make recommendations to City Council on how any new funds might be applied to public improvements in the TIF area.

HOW WILL TIF HELP?

Anticipated Benefits and Applications

A TIF district is an economic development incentive where public agencies set aside a percentage of new tax revenue derived from the future value of improved property or new businesses to pay for the current costs of development. For this area TIF, the City and County essentially reserve the pledged revenues separate from normal tax revenues, and those pledged monies may only be used to make improvements in the TIF district. In Highland Heights, Kentucky, the City has pledged 80% of new property, payroll, and occupational license taxes to the district; Campbell County also participates by pledging 60% of new property and payroll taxes for parcels and businesses in the targeted areas. TIF districts are critical to development because necessary infrastructure that is pivotal to a project’s success is usually prohibitively costly for a developer or business to bear out exclusively. TIF is the key public sector assistance mechanism to aid in significant real property development.

FOR MORE INFORMATION

Campbell County’s economic development office assists in administering six active TIF districts. Contact Justin Otto at (859) 547-1806 or JOtto@CampbellCountyKY.org if you would like to know more.

CAMPBELL COUNTY FISCAL COURT – 1098 MONMOUTH STREET – NEWPORT, KENTUCKY 41071